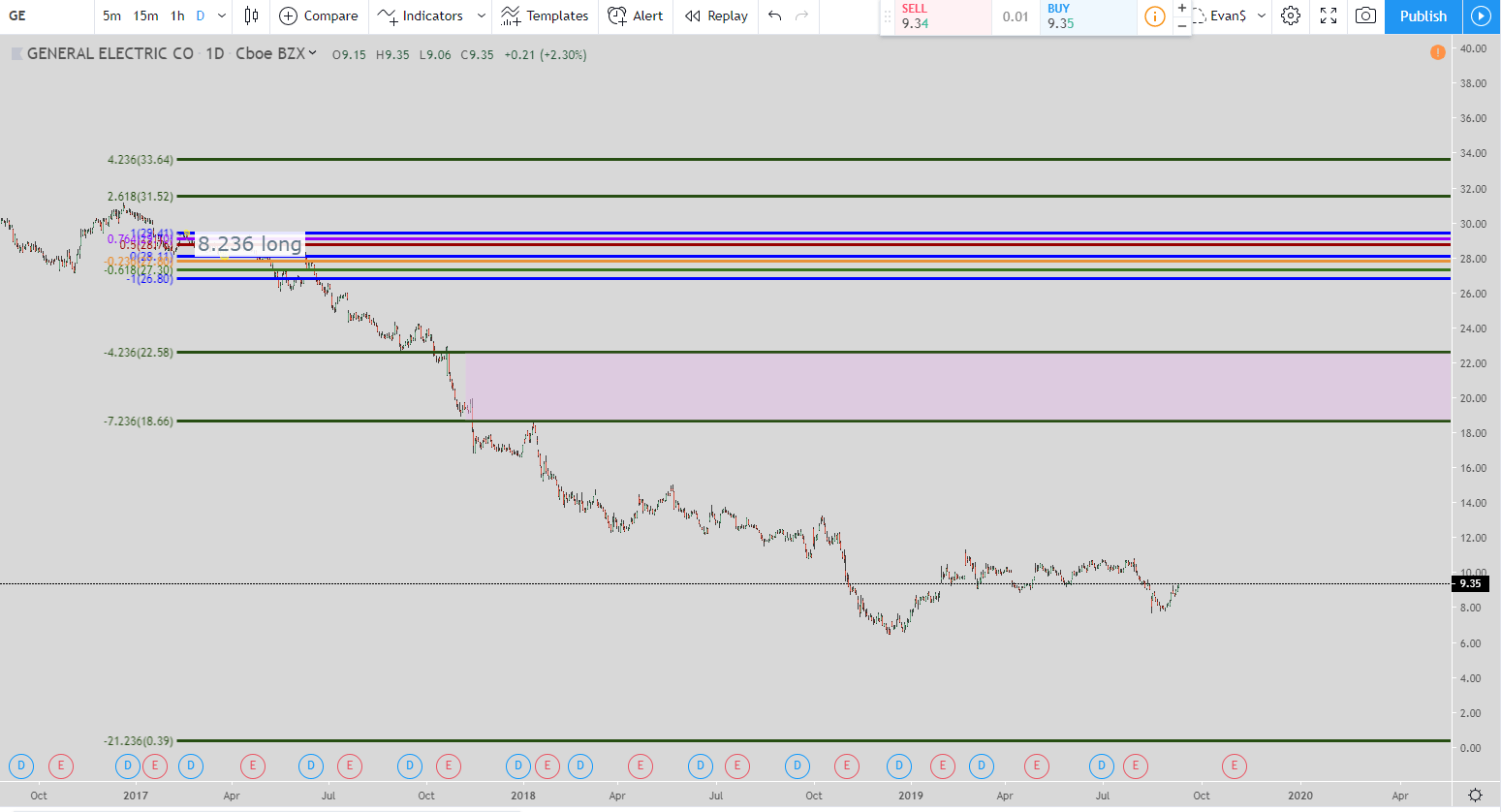

Despite this, the last trade on January 8 was at $7.19, which is still a 1,098% return from the January 6 close. By that time, investors still had half a trading day to “correct” their mistake. Signal, the messaging app, published a tweet at 11:12 AM on January 8 clarifying that it was not Signal Advance (see below). That’s a 1,482% return from the January 6 close. As we can see from the intraday price chart from CNBC above, Signal Advance’s stock moved up pretty quickly following Musk’s tweet and reached an intraday high of $9.49 early on January 8. Signal Advance is trading in the OTC/Pink Sheets and, prior to Musk’s tweet, closed at $0.60 on January 6. For example, see articles here, here, and here, However, people somehow ended up buying the stock of “Signal Advance” and bidding up its price significantly This has been widely covered. What he meant was the messaging app Signal. What Happened?Īt 4:56 AM on January 7, 2021, Elon Musk sent out the tweet “Use Signal” to his followers. Thus, even when investors made a “mistake” and a clear “correction” has been issued and widely disseminated, we can see that the market price of the stock still deviated substantially from the firm’s value and it can do so for a very long time. After another week, the closed at $6.25 on January 22, which is still at more than 10x the price before Musk’s tweet. By the end of the following week, SIGL closed on January 15 at $13.54, more than 20x its pre-Musk tweet price of $0.60. This is astonishing for a company that does not have any SEC filings related to the last four years of operations, only filed its 2016 Form 10-K in March 2019 (no SEC filings two years prior to that), and reported total assets in 2016 of $2,891 (that’s less than three thousand dollars) with no revenues for each year from 2014 to 2016. More surprising is that, after the weekend, SIGL stock increased to over $70 at one point to close on Monday, January 11, at a price of over $38 on more than 2 million shares traded and a market cap of over $2.5 billion.

What’s surprising is that Signal the messaging app tweeted that same day that it was not affiliated with SIGL.

However, the price of an unrelated OTC pink sheet stock named Signal Advance (ticker: SIGL) that had a closing price of $0.60 on January 6 shot up and closed at over $7 on Friday, January 8. On January 7, Elon Musk tweeted “Use Signal.” This was in reference to a messaging app. Now, we have an even clearer example of how price can substantially deviate from value. In my prior blog post, I discussed how investors put money in the wrong Zoom stock and caused an unrelated stock’s price to increase by over 300% over a two-month period.

0 kommentar(er)

0 kommentar(er)